The real pain behind digital fraud

The loss of money is painful, but there is more. People feel shame and don’t talk about it. They live in fear, even after the fraud ends. They stop trusting others—and themselves. Some even feel hopeless.

Many victims say the pain is not about the money. It is the feeling of being used and fooled. It is the feeling that no one understands. Digital fraud leaves deep wounds that no one can see.

When someone faces digital fraud, they often feel a deep pain that others do not notice. It is not only about losing money. They also lose their trust in others, in systems, and sometimes in themselves. Many people sit alone, feeling sad, thinking they made a mistake. They blame themselves for not being more careful.

In the end, what truly matters is not how fast a solution comes. What matters is how supported the person feels. When someone stands beside you in your pain, it truly gives you strength. They’re not leading you or behind you, but right there, next to you. That kind of support makes a difference inside the heart.

It is not about giving long talks. It is about being there quietly, making space for healing.

We must remember, behind every case of digital fraud is a real person. That person feels fear, carries pain, and hopes someone will stay and care.

In the quiet corners of modern life, where mobile phones ring gently and screens glow softly, a new kind of trap has taken shape. It is not made of steel or iron. It does not come in the form of handcuffs or prison cells. Yet, it holds people just as tightly. This is what many now call the “Digital Fraud.”

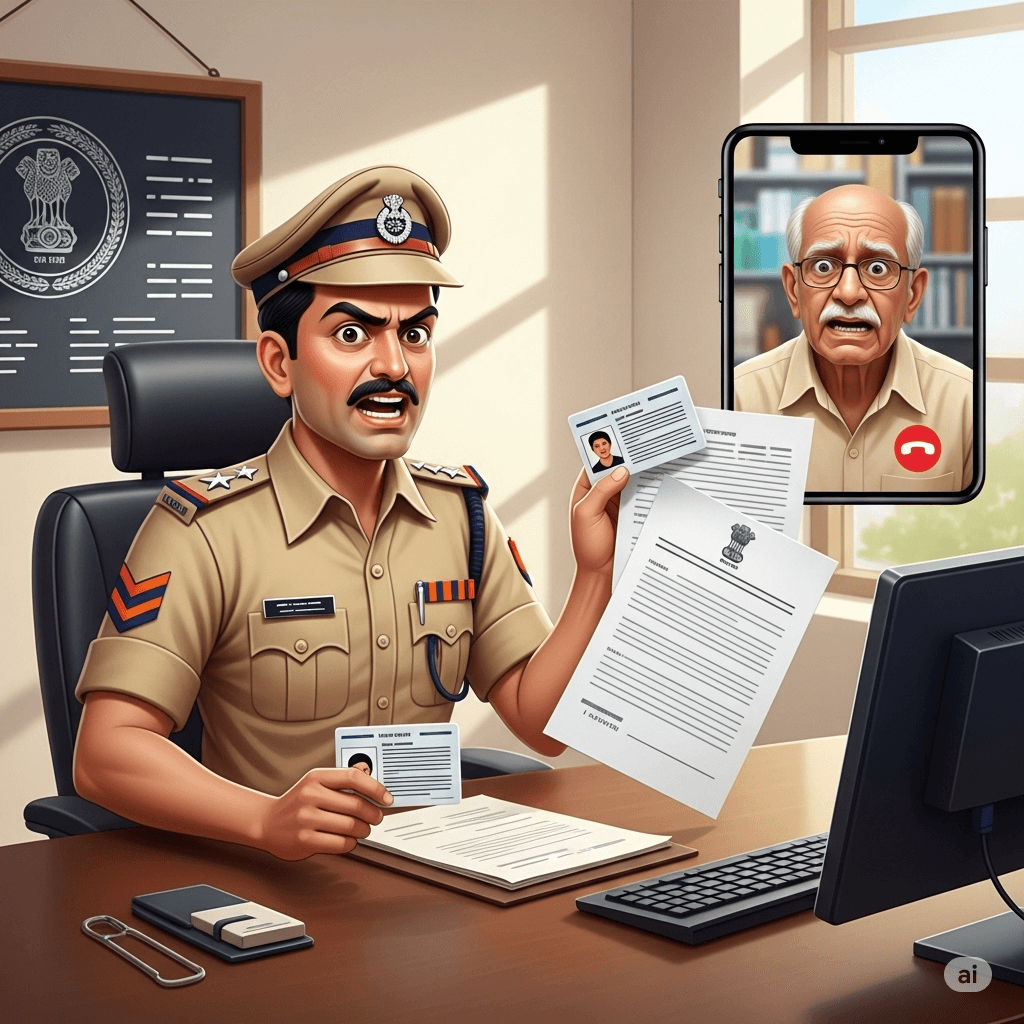

It begins with a simple phone call. A voice claims to be from the police, the court or another high authority. The caller speaks with confidence. A parcel, they say, has been sent in your name. It contains illegal items. Your name has been used in a crime. You must act quickly. And so begins a day or many days, of fear.

The West Bengal Case: A Wake-Up Call

Recently in West Bengal, a group of nine people was sentenced to life in prison. Their crime was not murder or robbery in the traditional sense. Instead, they tricked over a hundred people. Through fake calls and false documents, they created fear. They stole more than Rs. 100 crore. One man, aged 70, lost Rs. 1 crore. He was kept under pressure for seven full days. Another lost Rs.41 lakhs while caring for his ill wife.

These stories are not rare anymore. They are signs of a growing problem. A problem that hides behind screens and travels over the airwaves.

How the Trap is Set: Deceitful Techniques in Digital Fraud

These aren’t quick or sloppy scams. Instead, they’re built with a lot of patience and careful planning, made specifically to confuse people, make them feel alone, and take control. Here is how the fraud often unfolds:

- The First Call: Sowing Fear

It usually starts with a phone call. The caller speaks in a serious and official tone. They introduce themselves as a police officer, income tax officer, narcotics bureau officer, or courier boy. When the victim receives the call, they are threatened by saying that a parcel in their name has been caught, which contains fake documents, cash, or drugs.

These visuals create such a sense of urgency that no doubt remains about anything else.

- Isolation Through Intimidation

The victim is warned not to speak to anyone—not family, not friends—until the “case” is resolved. They are told their phone is being tracked. They are kept on the call for hours, sometimes for days. This isolation is not accidental. It is the most powerful tool the fraudster uses. A frightened person, left alone, becomes easier to control.

- The Video Call: A Show of False Authority

Later, a video call may be arranged. A person appears wearing a police or government uniform. Behind them is a flag or a board with an official seal. They hold up fake ID cards, forged letters, or court orders. The setup is often convincing. These visuals create such a sense of urgency that no doubt remains about anything else.

- The Emotional Pressure

The fraudsters do not simply demand money. They build pressure step by step. They speak of Fraud, jail, and the damage to the victim’s reputation. They say this is the only chance to “cooperate.” The person begins to feel trapped, unsure of what is real. Panic replaces reason.

- The Demand for Payment

Next comes the request for “verification money” or a “security deposit.” The victim is told that the funds are needed temporarily and will be returned after investigation. Bank transfers, UPI payments, and sometimes even cryptocurrency are used. The money is often taken in small amounts, over several transactions, to avoid suspicion.

- Fake Legal Procedures

Sometimes, fake emails are sent, showing court notices or FIR copies. The fraudsters may even create fake websites that look like government portals. The goal is to make the scam appear official and the victim more compliant.

- Continuous Monitoring

The victim is not allowed to disconnect the call. The fraudster keeps calling for hours and instructs the person to go to the bank to withdraw cash, send money to a specific account number, or install a particular app. This constant presence keeps the victim under control.

- The Sudden Silence

Once the money is sent and the victim is drained—emotionally and financially—the line goes dead. No more calls. No more threats. Only silence. By then, the damage is done.

What to do right after a digital fraud

When someone becomes a victim of digital fraud, time matters. One must act without waiting. The Government of India has a helpline — 1930. It works all the time. If money is taken, or if a trick is unfolding, a call to this number should be made at once.

There is also a website — www.cybercrime.gov.in. Here, one can write down the full story of what happened. All messages or calls from the fraudster should be saved and shared there.

The bank must be told as soon as possible. This can stop more loss. The bank may freeze the account or block the card.

In such moments, fear and shame often come. But no one should carry this alone. A family member or a social worker can stand by the person and help them feel less alone.

Remember, 1930 is not a number from the Reserve Bank. It is a national helpline to report digital fraud. It is there to help.

The Wounds We Cannot See: The Hidden Impact of Digital Fraud

Money can be counted. It can be lost and earned again. But the real harm runs deeper.

There is shame. Many victims never speak of what happened. They fear judgment. Some hide the truth from their families.

There is fear. The voice on the phone may be gone, but the memory stays. Some people cannot sleep. Some begin to doubt every call, every message.

There is broken trust. Not only in strangers, but in one’s own judgment. And sometimes, in the worst cases, there is despair.

How Social Workers Can Help After Digital Fraud

This is where the role of social workers becomes important. They may not carry a badge or wear a uniform, but they bring understanding, care, and time. Their work does not always get noticed, but it changes lives. They see pain that others do not see. They stand beside people when no one else does.

Creating Community Awareness

Social workers can visit to schools, CBOs, clubs and local gathering spots. They can explain how digital fraud works in simple ways. Posters, plays, and stories help people understand what to look out for. Many older people do not know how mobile phones work. They are easy targets. Teaching them how to block calls or report messages is important.

Awareness is not only about knowing. It is about understanding. It is about saying, “This can happen to me or someone I love.” Social workers can bring that message with care and patience.

Helping the victims after the fraud

When someone becomes a victim of digital fraud, they feel lost. Social workers can:

- Listen with care, without judging

- Help them file complaints

- Go with them to banks or police stations

- Offer emotional support

Even small help can rebuild confidence. Just talking to someone really helps a lot.

Long-term support for healing

The pain of digital fraud does not go away quickly. It stays in the mind. That is why social workers must stay connected.

- They can guide victims to mental health support

- They can arrange group meetings

- They can help families come together again

When a victim speaks, they begin to heal. When they are heard, they feel less alone. Healing is a long road. But it becomes easier when someone walks beside you.

Building better help systems

Digital fraud is growing. So our systems must also grow.

- Social work training must include digital fraud

- Police and hospitals should have help desks

- NGOs can set up helplines

A strong system makes it easier for people to get help. This makes it easier to defeat the fraudsters. If everyone in the family, along with banks, police, social workers, and other government officials, works together to help them, then fraudsters cannot succeed in their plan.

Phones and apps are not the enemy. But they can be used wrongly. That is the truth of digital fraud.

To stop it, we need more than police. We need people who can sit beside a person in pain and say, “You are not alone.” That is the role of a social worker. They do not fix everything. But they stay. They listen. They care.

In a world where digital fraud grows quietly, we need people who bring light—not with loud voices, but with simple, honest presence.

Let this not end in silence

Digital fraud may not lock us in cells, but it can lock our minds in fear. This must not remain a story of loss. It can become a story of recovery.

And for that, we need people who care. People who listen. People who stand beside us when the noise of the fraud ends—and the quiet begins.

Let us not forget that behind every number in a report is a real face, a real fear, and a real hope that someone will care enough to stay.